louisiana state inheritance tax

See where your state shows up on the board. Inheritance laws in the state of Louisiana can be complex.

An inheritance tax is a tax imposed on someone who inherits money from a deceased person.

. If the total estate asset property cash etc is over 5430000 it is subject to the federal estate tax form 706. Effective January 1 2012 no receipts will. With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a.

The Louisiana inheritance tax was repealed effective Jan. An inheritance tax is a tax imposed on someone. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from.

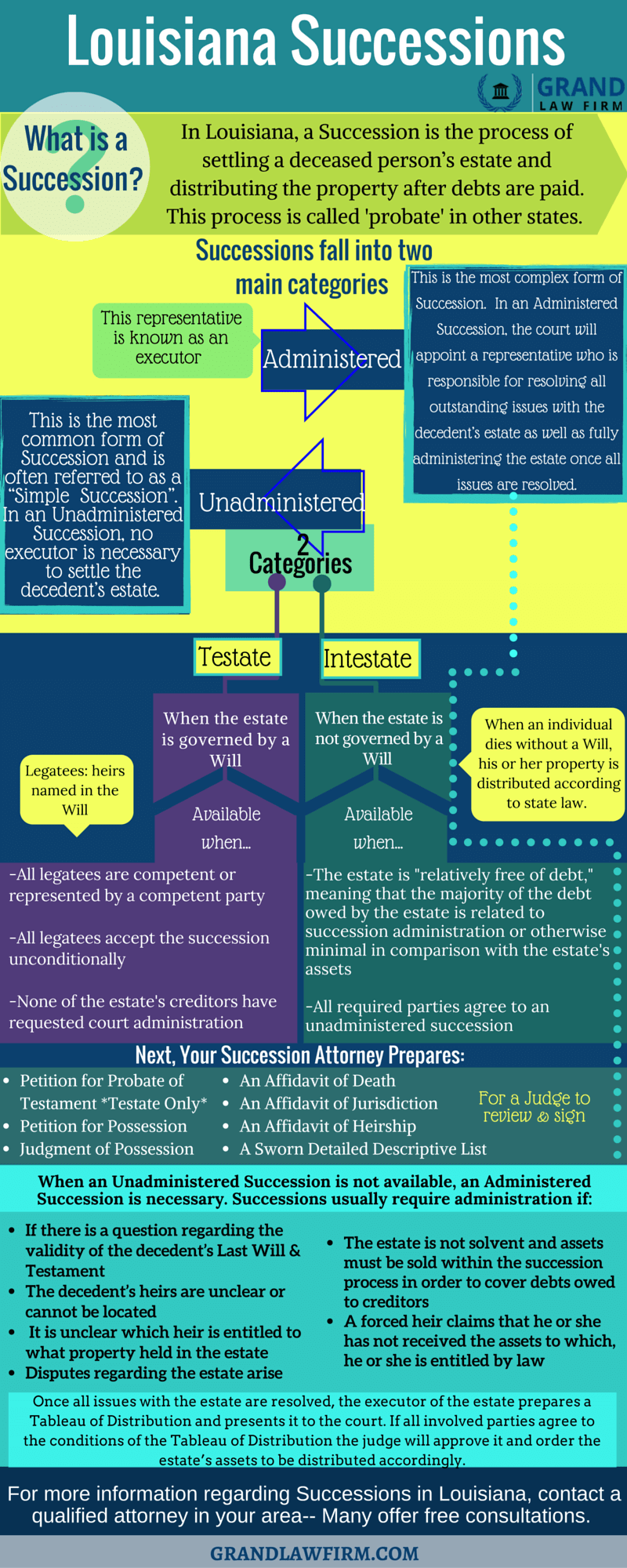

For example the state refers to probate as succession. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. The Economic Growth and Tax Relief Reconciliation Act of.

It operates almost like an. This law has been repealed and there is no longer an inheritance tax for people who died after June 30 2004. Inheritance tax laws from other states could in theory apply to you if you inherit property or.

His or her estate will be handled by intestate succession. The federal estate tax exemption is. Louisiana does not impose any state inheritance or estate taxes.

What is an inheritance. Maryland has the dubious distinction of being the. This is what I call the hidden estate tax.

Estates with Louisiana property that is worth over 125000 will likely have to go through the probate process according to Louisiana inheritance laws. Louisiana Inheritance and Gift Tax. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

Does Louisiana impose an inheritance tax. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more. Louisiana inheritance and gift tax.

There is no louisiana inheritance tax for people who die after june 30 2004. That is becasue an inheritance tax is a tax on the person who inherits the property not the estate itself. The inheritance could be money or property.

1 Inheritance tax due From Line 7 Schedule IV 2 Estate transfer tax From Line 8 Schedule IV 3 Interest due on inheritance and estate transfer taxes See instructions. Effective January 1 2012 no receipts. Total inheritance tax Forward to Line 4 Schedule IV Total due or refund due From Line 6 Schedule V 1401 Mail Date Schedule I Recapitulation of Detailed Descriptive List or.

Therefore nothing needs to be filed with the Louisiana Department of Revenue. No Act 822 of the 2008 Regular Legislative Session repealed the inheritance tax law RS. A benefit must be received in order for the tax to be levied.

The Act also provided that inheritance taxes due to the state for deaths occurring before July 1 2004 shall be considered due on January 1 2008 if no inheritance tax return was. There is no federal inheritance tax but there is a federal estate tax. Inheritance taxes can apply regardless of whether the deceased person had a Louisiana Last Will and Testament or died intestate.

Like the Federal estate tax laws Louisianas inheritance tax laws have undergone a lot of change. Its also a community property estate meaning it considers all the assets of a married couple jointly owned. The federal gift tax exemption is 15000 per year for each gift recipient.

LOUISIANA STATE INHERITANCE TAX The State of Louisiana has repealed all state inheritance taxes. If a person dies without a valid Last Will and Testament in Louisiana he or she is said to have died intestate. This means that the.

Louisiana no longer has either a state gift tax or a state estate tax. If youre looking for more guidance to navigate the complexities of Louisiana inheritance laws reading up on them beforehand will be a huge help. Inheritance tax allowed on the federal.

Thus there is no requirement to file a return with the State and no state inheritance. The executor pays the decedents outstanding debts using. Third and even more importantly for Louisiana residents if your estate is not structured correctly the property in your estate may be subject to the INCOME tax by foreging the step up in basis at death.

Iowa doesnt impose an. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. Louisiana does not have an inheritance tax.

When a person dies and leaves an inheritance the state must tax the wealth before the beneficiary collects their shares.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Louisiana Inheritance Laws What You Should Know Smartasset

Where S My State Refund Track Your Refund In Every State Taxact Blog

Louisiana Estate Tax Planning Vicknair Law Firm

Louisiana Successions A Brief Explanation

Louisiana Inheritance Tax Estate Tax And Gift Tax

Louisiana Health Legal And End Of Life Resources Everplans

State Estate And Inheritance Taxes Itep

Louisiana Small Succession Fill Out Printable Pdf Forms Online

Louisiana Succession Taxes Scott Vicknair Law

Louisiana Estate Tax Everything You Need To Know Smartasset

Historical Louisiana Tax Policy Information Ballotpedia

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Louisiana Inheritance Tax Estate Tax And Gift Tax

Louisiana Estate Tax Everything You Need To Know Smartasset